Why Earning More Still Feels Like Less (and What to Do About It)

👋 Hey friend,

Ever notice how no matter how hard you work, your paycheck feels thinner each month? You’re not alone — almost half of Americans now say they don’t earn enough to cover living expenses. That’s not just a stat… it’s the reality breathing down people’s necks.

So the question is: how do you break out of the paycheck trap without burning out? Let’s dig in.

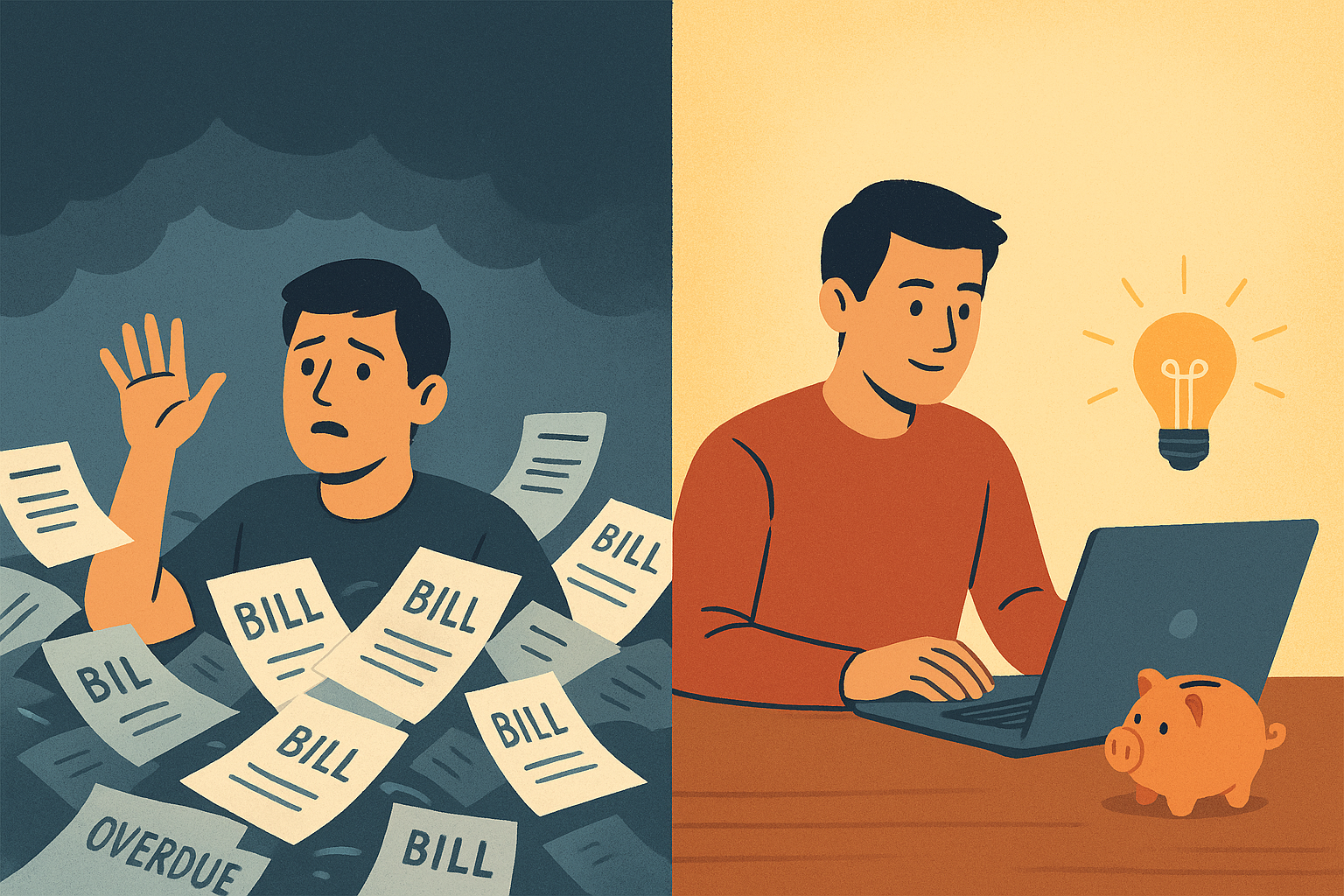

🔍 Real Talk: The Money Trap (and the Way Out)

First, the gut-punch reality: 47% of Americans say their income can’t cover basic living costs (CBS News). Think about that — nearly half the country is running on fumes, even with multiple jobs or long hours.

Now, here’s the flip: younger generations aren’t waiting for a miracle. Gen Z is betting on side hustles and entrepreneurship to build financial security, with many already seeing them as essential for retirement (Investopedia). That doesn’t mean everyone needs to launch a TikTok empire… but it does mean the old “work one job, save a little, retire at 65” blueprint is broken.

And here’s the overlooked piece: even with extra income, if you don’t master your money habits, you’re still stuck. Experts say just two habits — automating savings and tracking spending triggers — can dramatically reduce financial stress (Investopedia). The kicker? Those habits work whether you’re making $40k or $400k.

👉 See how the pieces connect? The trap is real, but the exit ramps exist:

- Build additional streams of income (side hustle, small venture, investing smarter).

- Anchor yourself with stress-proof money habits.

- Stop waiting for “someday” to make your situation better.

💡 Takeaway: The hustle gets you options. The habits make sure those options stick.

✅ Smart Money Moves (Quick Wins for You)

Here are 3 bite-sized moves you can run with this week:

- Run a “stress test” on your budget. Pretend you lost 20% of your income. What stays? What goes? This forces you to see where leaks and “luxuries disguised as needs” live.

- Carve out 1 auto-saving rule. Even if it’s $10 a week — the habit matters more than the number. Over time, this anchors your financial confidence.

- Audit your time like your money. If Gen Z is right, your side hustle is built from stolen hours. Block one 90-minute slot this week and protect it fiercely.

📚 Resource Hub

When the paycheck trap feels suffocating, knowledge is the oxygen.

- Super Investor Club (SIC) – If you want to learn how seasoned investors create real wealth streams (without 24/7 trading), SIC is a community that breaks down Buffett-style strategies into practical steps. Check out SIC here.

- Smart Money Reads – Want more curated takes on today’s money shifts? These are hand-picked newsletters worth your scroll, packed with insider lessons you won’t find on TikTok.

🌟 Closing Note

Look, the system won’t suddenly change in your favor. Inflation won’t politely pause. Employers won’t hand out 20% raises because you asked nicely.

But you don’t need all that. What you need is ownership of your next move — whether it’s setting up one new money habit, carving time for your side project, or joining a community that lifts your game.

💬 The next step isn’t massive. It’s just yours.

— Sky