The rush, the risk, the reality: Trading in 2025 🚨

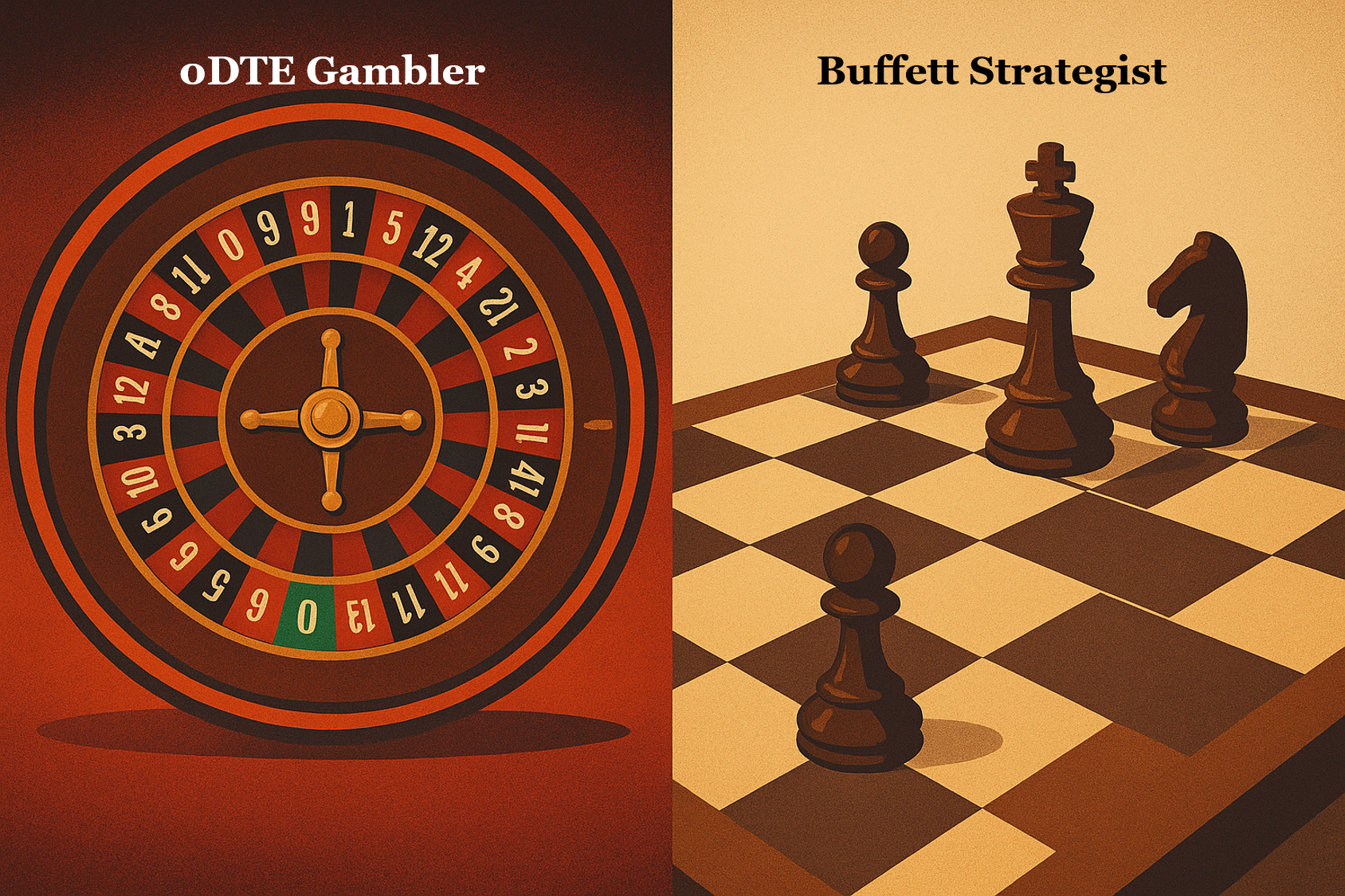

Every market cycle has its obsession — and right now, it’s zero-day options. Traders are piling in, chasing adrenaline and quick wins. But behind the flashing lights is a quieter story: institutions playing a different game entirely. This week, we’ll cut through the hype, expose how pros really use options, and show you how to flip the odds in your favor — without getting burned by FOMO.

🚀 Smart Money Moves – “Stop Playing Their Game”

The markets are buzzing with record-breaking options volumes — but before you dive into the hype, remember this: every boom hides a trap.

Here are 3 quick plays to keep you ahead this week:

- Flip the script on time decay → Instead of buying short-dated options, learn how to sell time like the pros. This shifts the odds in your favor.

- Separate thrill from income → If your trade excites you, it’s probably riskier than you think. Real pros get bored collecting premiums.

- Stack Plan B income streams → One trading method is never enough. Balance your portfolio with alternative income sources.

👉 This week’s deeper dive is all about options — the frenzy, the myths, and the Buffett-approved way to use them.

📰 Real Talk – Options Mania vs. Options Mastery

🎲 The Trap: FOMO in Zero-Day Options

“Retail traders just can’t quit risky zero-day options as trading volume booms.” — MarketWatch, Jul 2025

Read full article →

Zero-day (0DTE) options are booming because they’re cheap, exciting, and promise quick wins. But what most traders don’t realize is that theta decay is the hidden tax — every minute you hold, the odds tilt harder against you.

💡 Insider tip: Professionals rarely buy these. They’re usually the ones selling them to retail dreamers.

♟️ The Reality: How Pros Actually Use Options

“Options Trading Strategies: Why 2025 Options Volume Is Surging.” — TradeVision, May 2025

Read full article →

Institutions don’t gamble on 5-minute moves. They use spreads, covered calls, and cash-secured puts — strategies that create steady cash flow while protecting capital.

💡 What this means for you: Options can actually be less risky than stocks when structured properly. That’s how Buffett built ownership stakes: he sold puts, collected premiums, and bought at his price.

💵 The Opportunity: Options as Income

“25 Passive Income Ideas To Make Extra Money In 2025.” — Bankrate, Aug 2025

Read full article →

Passive income isn’t just about rental checks or dividends. Options — when used as income tools — let you get paid while waiting for great stocks. That’s Buffett’s playbook, and it’s still alive today.

👉 The trap: chasing excitement while ignoring structure.

👉 The reality check: pros sell risk instead of buying it.

👉 The move: learn to treat options as income, not a lottery ticket.

💼 This is where the Super Investor Club (SIC) shines — it’s a community where traders learn Buffett-style options that pay you while you wait.

🔑💼 Join SIC today and master options the Buffett way →

📚 Resource Hub – Your Wealth Toolkit

Instead of “one-size-fits-all,” think of this as a toolbox. Open the drawer that solves today’s problem:

- If you’re tired of gambling with options… → Super Investor Club (SIC) shows you how to turn options into steady income, Buffett-style.

- If forex swings keep wrecking your account… → TAD Forex System arms you with recovery mechanics, so one bad trade isn’t the end.

- If you want Plan B income outside markets… → Go-Leap guides you through shortcut paths to building extra online revenue.

- If you’re short on time but still want to trade… → IRIS gives you a 1-hour-a-day disciplined stock trading blueprint.

👉 Choose your tool, not your trap.

Curated extras worth your time: Good stuff that we read too.

✨ Final Word

Markets will always dangle shiny new toys. The trick isn’t to avoid them — it’s to see how the pros actually use them and copy the discipline, not the hype.

This week, remember: you don’t have to play their game. With the right structure, you set the rules.

Stay sharp,

— Sky