3 Financial Traps That Keep You Broke (and How to Escape)

Ever feel like money has its own mind? One week you’re saving like a pro, the next you’re “accidentally” splurging on things you don’t need. Add economic turbulence and the pressure to “hustle smarter,” and it’s no wonder financial independence feels like chasing a moving target.

The good news: today’s issue breaks that down. We’re unpacking three fresh insights - how to outsmart spending traps, grow a side hustle with serious potential, and build habits that hold steady even if the economy wobbles.

🧠 Real Talk: The Traps vs. The Truth

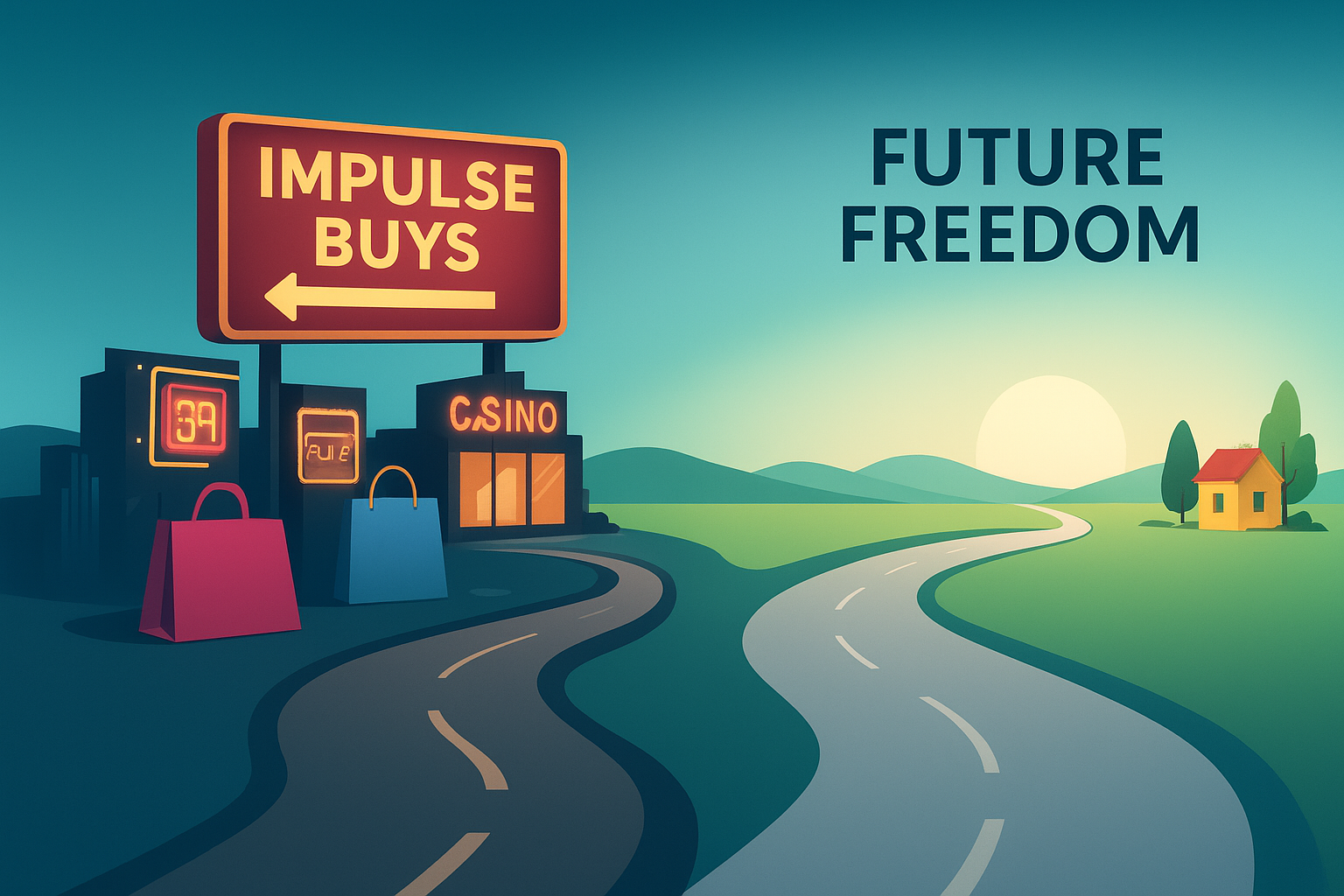

AP News recently spotlighted how most of us know what we should be doing with money… but our brains betray us. That “sale” that feels urgent? Or the dinner out that seems harmless? Behavioral economics calls this hyperbolic discounting, choosing small pleasures now over bigger payoffs later.

✅ Reality check: Three simple moves fight back: set micro-goals, automate part of your savings, and give your money a “job” before it slips away.

2. The Hustle Myth vs. Scalable Side Hustles

Investopedia showed how billion-dollar companies like Apple and Instagram started as “side hustles.” The myth? That hustles are just pocket change. The reality? With structure, clear goals, market alignment, lean launch and consistent iteration, they can become serious wealth engines.

👉 For readers: Whether it’s selling a skill, building a digital product, or freelancing, think less “extra cash” and more “mini-business with legs.”

3. Economic Fear vs. Resilient Habits

Nasdaq’s recent piece made it plain: recessions aren’t “if,” they’re “when.” And the winners are those who build resilience before the storm. Four habits stood out - hold extra cash, shore up emergency funds, automate investments, and cultivate multiple income streams.

💡 Reminder: These aren’t “rich person” strategies. They’re simple, repeatable habits you can implement even if you’re still paycheck-to-paycheck. Small steps compound.

💬 Want to build these resilient habits with others who are already walking the path? That’s exactly why I created Super Investors Club (SIC), a space where everyday investors grow together using timeless strategies inspired by Buffett. It’s not about quick wins but building your financial moat brick by brick.

🚀 Smart Money Moves (Curated for You)

📌 Instead of chasing endless articles, here’s a curated pick of financial reads that align with today’s theme so you don’t waste time hunting for reliable strategies.

👉 Explore the Smart Money Moves here

✨ Closing Note

At the end of the day, financial independence isn’t about making perfect choices. It’s building systems that protect you from your imperfect ones. Whether that’s automating savings, turning a passion into a side hustle, or building recession-proof money habits, the power is already in your hands.

The next move is yours.

🌱 Take ownership. Start small. Stay consistent. Because peace and freedom are worth building.

— Sky